Запись блога пользователя «Alina Chinner»

Investing in gold has lengthy been thought-about a safe haven for buyers looking to hedge towards inflation, financial downturns, and foreign money fluctuations. With its intrinsic worth and historical significance, gold remains a well-liked asset for diversifying funding portfolios. If you adored this article therefore you would like to receive more info with regards to click here for more info kindly visit the webpage. This case examine explores the best ways to buy gold for investment, offering insights into varied methods, their professionals and cons, and key issues for potential investors.

Understanding Gold as an Funding

Gold is a novel commodity that has been used as a form of currency and a retailer of worth for hundreds of years. Unlike stocks or bonds, gold does not generate income, nevertheless it tends to retain its value over time. Throughout durations of economic uncertainty, buyers typically flock to gold, driving its worth larger. Therefore, understanding the dynamics of the gold market is crucial for making knowledgeable investment selections.

Completely different Ways to Buy Gold

- Bodily Gold

- Gold Coins: Widespread choices include the American Gold Eagle, Canadian Maple Leaf, and South African Krugerrand. Coins often carry a premium over the spot worth of gold because of their collectible nature and the prices of minting. When shopping for coins, investors should guarantee they are buying from reputable dealers to avoid counterfeit merchandise.

- Execs and Cons: The first advantage of physical gold is its tangibility and intrinsic value. Nevertheless, it comes with challenges such as storage, insurance costs, and potential liquidity issues when selling.

- Gold ETFs (Alternate-Traded Funds)

- Execs and Cons: Gold ETFs provide liquidity, ease of buying and selling, and decrease storage costs compared to bodily gold. Nonetheless, they may include administration fees, and buyers don't own the physical gold, which could also be a drawback for some.

- Gold Mining Stocks

- Pros and Cons: Gold mining stocks can provide leveraged publicity to gold costs, because the profits of mining firms can enhance significantly with rising gold prices. However, these stocks are subject to additional dangers, corresponding to operational points, administration selections, and geopolitical components that can affect mining operations.

- Gold Futures and Choices

- Execs and Cons: These derivatives can offer significant profit potential and permit traders to hedge against worth fluctuations. Nonetheless, additionally they carry a excessive degree of danger and complexity, making them unsuitable for novice buyers.

Key Concerns for Buying Gold

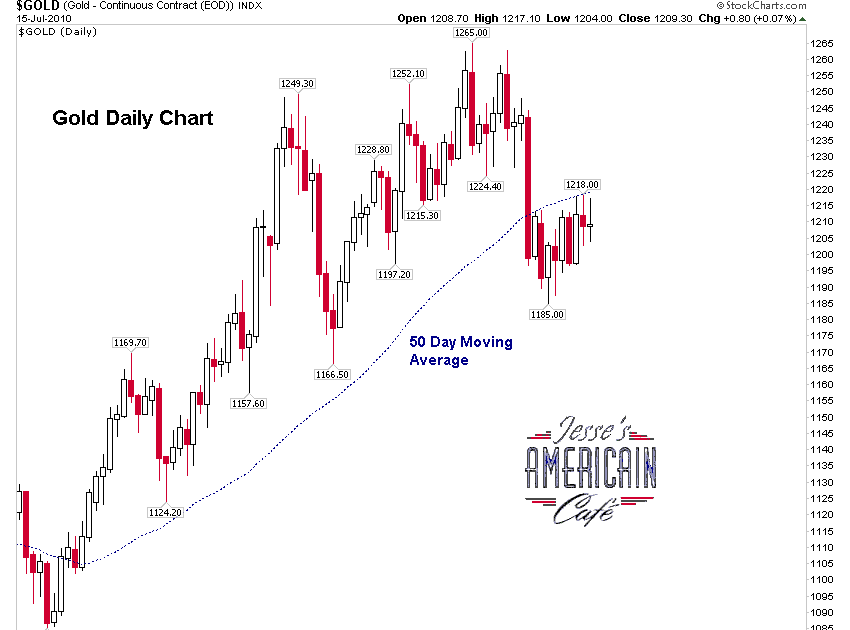

- Market Analysis: Earlier than investing in gold, it is crucial to conduct thorough analysis on market tendencies, historic worth movements, and factors influencing gold costs, similar to curiosity charges, inflation, and geopolitical events.

Conclusion

Investing in gold could be an efficient technique for defending wealth and diversifying an funding portfolio. The best way to buy gold for investment is dependent upon particular person preferences, threat tolerance, and investment goals. Whether or not choosing bodily gold, ETFs, mining stocks, or futures contracts, it is important to conduct thorough research, work with reputable sellers, and consider the related dangers and costs. By taking a strategic method to gold funding, buyers can position themselves to profit from the distinctive benefits that gold provides within the monetary markets.