Blog entry by Alina Chinner

Buying gold has always been a well-liked investment selection, especially during times of economic uncertainty. Gold isn't only a logo of wealth, however it additionally serves as a hedge in opposition to inflation and forex fluctuations. In this case research, we are going to explore varied places to buy gold, the advantages and disadvantages of each, and provide insights into making knowledgeable investment selections.

1. Native Jewelers

Local jewelers are sometimes the primary stop for people looking to purchase gold jewelry or coins. They provide a personal touch and the chance to see the product up close.

Advantages:

- Personalized Service: Jewelers can present tailored recommendation and education on gold merchandise.

- Increased Premiums: Jewelers sometimes cost higher premiums over the spot value of gold resulting from their markup for craftsmanship and overhead costs.

2. Online Gold Dealers

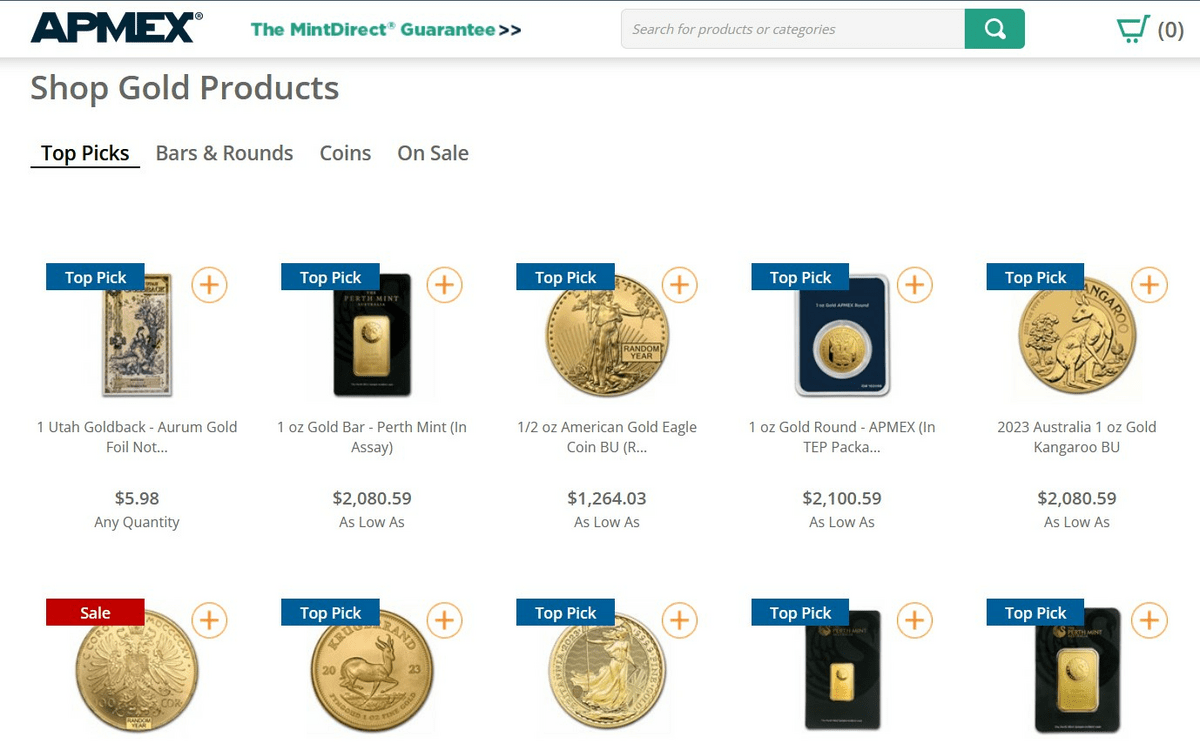

The rise of e-commerce has led to the emergence of numerous on-line gold sellers, similar to APMEX, JM Bullion, and BullionVault. If you loved this information and you want to receive more information with regards to Best Way to buy gold and silver please visit the site. These platforms provide a variety of gold merchandise, including coins, bars, and bullion.

Advantages:

- Aggressive Pricing: On-line sellers usually supply decrease premiums in comparison with traditional jewelers due to diminished overhead prices.

- Transport Risks: There's a risk of loss or theft during delivery, and buyers could must pay for insurance.

3. Coin Outlets

Coin shops concentrate on numismatic coins, which might include gold coins. These institutions typically cater to collectors and buyers alike.

Benefits:

- Skilled Knowledge: Coin store house owners and staff typically have extensive data about gold coins and their worth.

- Larger Premiums on Uncommon Coins: Whereas bullion coins could have lower premiums, uncommon coins can carry important markups.

4. Banks

Certain banks provide gold bullion and coins on the market to customers. This selection is usually neglected but can present a secure approach to invest in gold.

Advantages:

- Safety: Banks provide a secure setting for buying gold, and transactions are typically straightforward.

- Limited Availability: Not all banks sell gold, and those that do may have a restricted choice.

5. Gold Exchanges

Gold exchanges, such because the London Bullion Market and the brand new York Mercantile Exchange, present a platform for buying and selling gold. These exchanges are primarily for institutional traders but may also be accessed by particular person buyers by brokers.

Benefits:

- Market Pricing: Buyers can buy gold at market costs, typically with lower premiums.

- Complexity: Understanding easy methods to navigate exchanges can be difficult for novice investors.

6. Gold ETFs and Mutual Funds

For those who prefer not to carry bodily gold, change-traded funds (ETFs) and mutual funds that invest in gold might be a sexy choice. These funds observe the worth of gold and allow investors to realize exposure without the trouble of storage.

Benefits:

- Liquidity: Gold ETFs can be bought and offered simply on stock exchanges.

- Administration Fees: ETFs and mutual funds charge administration fees that may scale back overall returns.

Conclusion

When considering where to buy gold, it is essential to judge the benefits and disadvantages of every choice. Local jewelers present a personal contact, while on-line sellers supply comfort and aggressive pricing. Coin retailers cater to collectors, and banks provide security and trustworthiness. Gold exchanges permit for market pricing, while ETFs and mutual funds provide liquidity without the necessity for bodily storage.

In the end, the best place to buy precious metals online place to buy gold will depend on particular person preferences, investment targets, and risk tolerance. Conducting thorough analysis, evaluating prices, and understanding the market may help buyers make informed choices. Whether purchasing bodily gold or investing through monetary instruments, gold stays a precious asset in any funding portfolio.